Sbi Sb Interest Rate

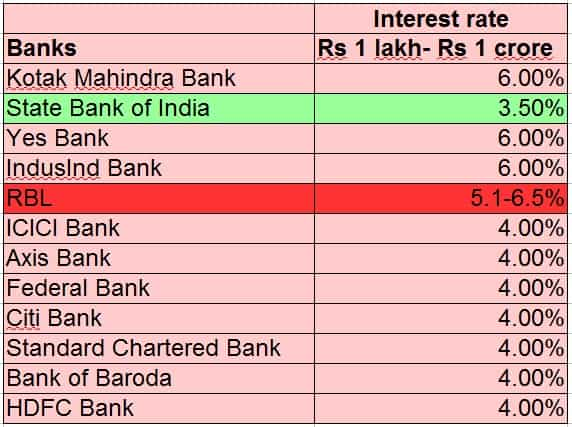

For example, the current repo rate is at 6%. Hence, the current SBI Savings Account Interest Rate for the money which is beyond Rs.1 lakh will be arrived as below. SBI Savings Account Interest Rate (For. The interest for the 'SBI savings bank account' is a floating variable rate that has no fixed maturity period. It has no minimum balance requirement with interest calculated on daily balance. It is accessible through internet banking and mobile banking. The rate of 4.00% is 0.14% higher than the average 3.86%.

The country's largest lender SBI on Wednesday rationalised interest rate on all savings bank (SB) accounts to a flat 3 per cent, a move affecting 44.51 crore account holders.

The bank also waived the requirement for maintaining minimum balance in SB accounts.

Keeping in mind the 'Customers First' approach, the bank further said it has also waived SMS charges, which will bring significant relief to all the customers.

'Bank has also rationalised interest rate on SB Account to a flat 3% p.a. for all buckets,' it said.

Currently, the interest rate on SB accounts is 3.25 per cent for deposits up to Rs 1 lakh in SB accounts, and 3 per cent for deposits above Rs 1 lakh.

The State Bank of India (SBI) decided to waive maintenance of Average Monthly Balance (AMB) for all SB accounts.

'The charges on maintaining AMB are now waived off on all 44.51 crore SBI savings bank accounts,' it said.

Currently, SBI customers need to maintain AMB of Rs 3,000, Rs 2,000 and Rs 1,000 in metro, semi urban and rural areas, respectively.

The bank used to levy a penalty of Rs 5 to Rs 15 plus taxes on non-maintenance of AMB.

Further, SBI has reduced the one-year MCLR to 7.75 percent per annum from 7.85 percent, with effect from March 10.(File)Sbi Sb Interest Rates Calculator

State Bank of India (SBI) on Wednesday reduced and rationalised interest rate on all savings bank (SB) accounts to a flat 3 percent, in a move that could hit its 44.51 crore account holders. Simultaneously, it also decided to waive off the maintenance of average monthly balance (AMB) for all SB accounts. SBI also announced a reduction in its marginal cost-based lending rate (MCLR) by 10-15 basis points (bps) across all tenors.

The bank currently pays 3.25 percent interest on SB accounts with a balance up to Rs one lakh and 3.25 percent on accounts with balance above Rs 1 lakh. Now, SBI will pay a uniform 3 percent interest rate on all SB accounts.

Currently, the bank’s SB customers need to maintain AMB of Rs 3,000, Rs 2,000 and Rs 1,000 in metro, semi-urban and rural areas, respectively. SBI used to levy a penalty of Rs 5 to Rs 15 plus taxes on non-maintenance of AMB. Other nationalised banks too are expected to waive off AMB maintenance and cut SB deposit rates in the coming days. The AMB waiver is a “major initiative to bring “customer delight and a hassle-free banking experience”, SBI said.

Further, SBI has reduced the one-year MCLR to 7.75 percent per annum from 7.85 percent, with effect from March 10.

Consequently, EMIs on eligible home loan accounts (linked to MCLR) will get cheaper by around Rs 7 per Rs one lakh on a 30-year loan. EMIs on car loans will also be reduced by Rs 5 per Rs one lakh on a 7-year loan. The state-owned lender also cut the three-year MCLR from 8.15 percent to 8.05 per cent and three-months MCLR from 7.65 per cent to 7.50 per cent.

Sbi India Interest Rates

SBI also cut interest rates on term deposits (TDs) with effect from March 10. Retail TD interest rates have been cut by 10 bps for ‘one year & above’ tenor and 50 bps for deposits up to ‘45 days’. Bulk TD interest rates have been reduced by 15 bps for deposits in ‘180 days & above’ tenors.