Fnb Fixed Deposit

- Fnb Fixed Deposit Botswana

- Fnb Fixed Deposit Rates For Seniors

- Fnb Fixed Deposit Interest Rates South Africa

- Fixed Deposit Account

- Fnb Fixed Deposit

Fnb Fixed Deposit Botswana

The Flexi Fixed Deposit Account by FNB requires a minimum opening deposit of R5 000. You can get a maximum nominal interest rate of 6.60% over 12 months. This investment account has a fixed term, and you still get access to a portion of your capital within a day (24 hours).

The Flexi Fixed Deposit Account is risk-free and your capital and quoted returns are guaranteed. During your investment period, you can make two withdrawals of up to 15% of your invested capital with FNB. You have the option to add more money to your account.

Fixed period + interest rate. Deposit a sum of money for a fixed period of time at a fixed rate of interest. The investment period ranges from as little as seven days to five years.

With this FNB account is linked to prime lending rates, you can schedule your transactions to make regular transfers into your Flexi Fixed Deposit Account.

Flexi Fixed Deposit features

Fnb Fixed Deposit Rates For Seniors

- You are welcome to make third party payment when you have enough funds available to do so

- Flexi Fixed Deposit Account with FNB has no monthly fees

- You can invest from 3 to 12 months

- Manage your account online with the FNB Internet banking

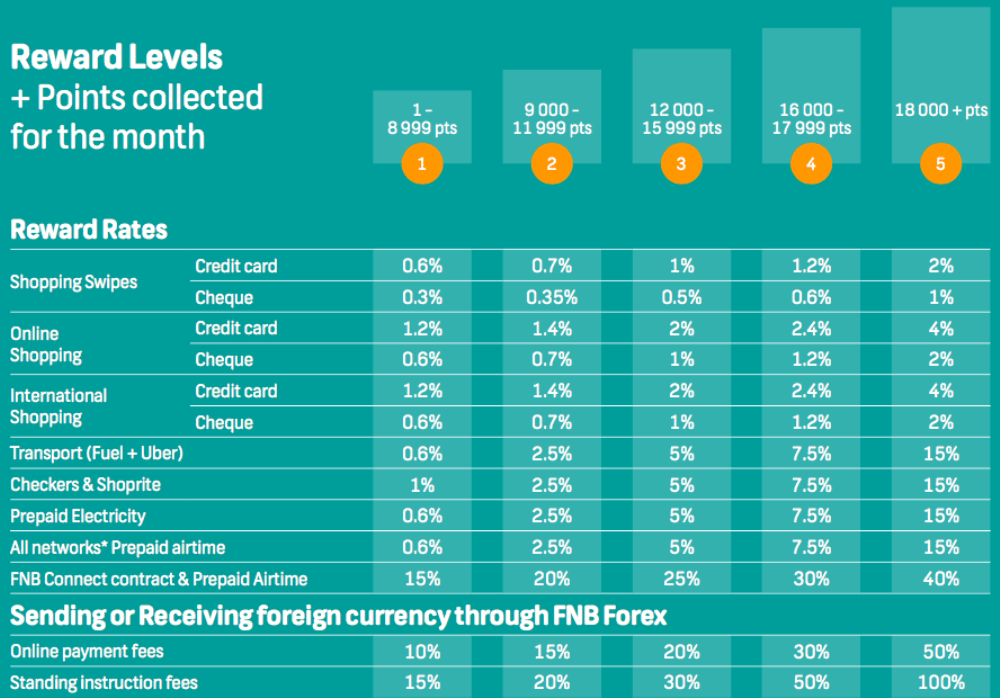

- Earn eBucks rewards

How to Apply

- you have to be a South African Citizen to qualify for the FNB Flexi Fixed Deposit Account

- You can apply online in easy steps OR have FNB contact you or contact them for investment purposes

- Have a minimum deposit amount of R5 000

- You may visit the nearest FNB branch

Fnb Fixed Deposit Interest Rates South Africa

Documents needed

Account Type Minimum Deposit Compounding Frequency Interest Rate Annual Percentage Yield; 3 MONTH CD: $2,500.00: Quarterly: 0.15%: 0.15%: 6 MONTH CD: $1,000.00. The FNB Fixed Deposit Investment Account is best suited for customers who are sure of their goals and are comfortable to put away their cash for longer and benefit from greater interest rates. FNB Fixed Deposit Investment Account Features: You will pay no monthly or transactional fees. Parkside First National Bank of Namibia LTD C/O Fidel Castro & Independence Ave Box 195, Windhoek Tel: 0 infonam@fnbnamibia.co.na The Parkside branch also services RMB, Homeloans.

Fixed Deposit Account

- Your Valid South African ID or Smart ID Card

- Proof of residence that’s not older than 3 months

Fnb Fixed Deposit

For more information visit the FNB Flexi Fixed Deposit Account Page. First National Bank is a division of FirstRand Bank Limited and it is an Authorized Financial Services and Credit Provider (NCRCP20)

Other Fixed Deposit Accounts

iBusiness on COVID-19