Dbs Fixed Deposit

- DBS/POSB fixed deposit board rates. With the effect from 4th May 2020, there is a downward revision of interest rates for DBS/POSB SGD Fixed Deposit. Note: The interest rates for 9 months and above tenors are applicable only to rollover placements at the same tenors.

- DBS BANK FD calculator online - Calculate DBS BANK FD Interest rate using DBS BANK Fixed Deposit calculator 2021. Check DBS BANK FD rate of interest and calculate FD final amount via DBS BANK FD Calculator on The Economic Times.

- Dbs Fixed Deposit Calculator

- Posb Fixed Deposit Rate

- Fixed Deposit Calculator

- Dbs Fixed Deposit Account

- Dbs Fixed Deposit Promotion

- Dbs Fixed Deposit Interest Rate

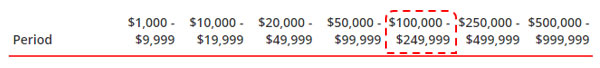

DBS FHR History and the New DBS FHR-9 Fixed Home Rate. DBS creates History when it launched the DBS Fixed Home Rate (FHR) package in 2015. The Fixed Home Rate FHR-12/24 is where the home loan package is pegged to the average of 12-month and 24-month Fixed deposit rate for deposits ranging from $1000 to $9999.

Accounts

Place your funds with the bank with 'Asia’s safest bank' awarded and enjoy higher returns

Enjoy enhanced yields, higher returns and improved liquidity with a DBS Fixed Deposit Account. Open an account and earn higher interest rates by placing your funds with us for a set period of time.

Why choose DBS Fixed Deposit Account?

- Ensure your funds are safe with an 'AA-' and 'Aa1'rated bank. DBS has been named the Safest Bank in Asia by Global Finance for five consecutive years, from 2009 to 2013

- Increase your returns with competitive interest rates that are higher than a typical Business Account

- Choose from a flexible range of tenures

- Improve your liquidity via a wide range of global and Asian currencies: AUD, CAD, CHF, CNY, EUR, GBP, HKD, JPY, NZD, SGD and USD

- Take advantage of our convenient cut-off times to make placements and withdrawals. You can also make early withdrawals if required

Product Features

Here are the available tenures for our account types for Fixed Deposits:

| Account | Minimum deposit amount | Tenure | Currencies |

|---|---|---|---|

| Fixed Deposit (CNY) | CNY 10,000 | Three and six months | CNY |

| One, two, three and five years | |||

| Fixed Deposit (FX) | No minimum requirement | One, three and six months | AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, SGD and USD. |

One year | |||

Call Deposit (CNY) | CNY 500,000 | One and Seven days | CNY |

Call Deposit (FX) | No minimum requirement | Seven days | AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, SGD and USD. |

| Corporate Plus Deposit (CNY) | CNY 500,000 | No fixed tenure | CNY |

Yes, you may make early withdrawals. There will be no penalty fee incurred; however, early withdrawals may result in you receiving a significantly reduced rate of interest than originally agreed. As such, you should consider making an early withdrawal carefully.

Please call us at 4008208988 should you need more information.

You will need to open a Fixed Deposit Account to place a Fixed Deposit.

Yes, however you will not have to complete the full set of documents. Please call us at 4008208988 and we will arrange for a relationship manager to assist you with your application.

Star of Innovation in Payments – Global Banking Stars of China Awards

Best Bank for Cash Management, China

Best Service Provider – E-solutions Partner in China

Best Transaction Bank in Asia

How do I apply?

Simply call us at 400 820 8988 (or +86 400 820 8988 if you're overseas) or visit any of our Branches. You may also email us and our Relationship Manager will contact you as soon as possible.

Disclaimer:

The information provided in this website is for general information only and nothing contained in this website constitutes an invitation, offer or solicitation with respect to the entry into transactions mentioned in this website or subscription, purchase or sale of any products, services, securities or other financial instruments mentioned in this website or the taking of any position or the adoption of trading strategy in respect of any asset class (eg. currency, interest rate, commodity, equity etc). The information provided in this website is not provided with regard to the specific investment objectives, financial situation and the particular needs of any particular person who accesses this website.

The information provided on this website is subject to change without notice, its accuracy is not guaranteed, and it may be incomplete or condensed. Accordingly, no representation or warranty, express or implied, is made as to the accuracy, completeness or fairness of the information in this website. We are not acting as your advisor or agent when providing the information in this website. The information in this website does not purport to identify the risks (direct or indirect) or other material considerations which may be associated with you entering into a particular transaction, subscribing for a particular service or purchasing or selling a particular security or financial instrument. Prior to entering into any proposed transaction or entering into any subscription, purchase or sale of any security or financial instrument, you should determine (after consultation with your own advisors if you deem fit), without reliance upon us or our affiliates, the economic risks and merits, as well as the legal, tax, accounting or other material characterisations and consequences of the transaction, subscription, purchase or sale, as the case may be, and that you are able to assume these risks.

We, and/or our affiliates, may hold, or trade, or act as market-maker, in any securities or other financial instruments mentioned in this website or related derivatives or may take positions or use trading strategies in respect of any asset class similar to or which differ from or be contrary to those mentioned in this website. We, and/or our affiliates conduct many businesses and activities that may relate to issuers of third party securities mentioned in this website and may provide broking, banking and other financial services to such issuers.

Anyone receiving or accessing this website must make their own assessment of the materials herein and conduct such investigations and seek such professional advice as they think fit for such purpose. The information provided on this site should not be regarded by recipients as a substitute for the exercise of their own judgment.

© DBS BANK LTD, 2019. All rights reserved. Any unauthorized use, duplication or disclosure is prohibited by law and will result in prosecution.

© Provided by MoneySmart Fixed deposit (sometimes called time deposit) accounts are low-risk investments that earn you interest over a fixed commitment period. You don't need to do anything to earn this interest, just park your money with a bank. Think of it like mold on a piece of bread. Just leave it out in the open and mold will grow — FREE! — on your bread for you. Seriously, though, fixed deposits are great if you have a substantial amount of money lying around and you don’t want to risk investing it. Fixed deposits are an extremely low risk way to grow your money.Best fixed deposit rates in Singapore (Feb 2021)

We've picked the highest fixed deposit rates for SGD in attainable deposit amounts (i.e. $50,000 and below). Note that these promotional rates change monthly and the bank can change the rates anytime.| Bank/financial institution | Min. deposit amount | Tenure | Interest rates |

| DBS | $1,000 | 18 months | 1.3% p.a. |

| Maybank | $1,000 | 36 months | 1% p.a. |

| Hong Leong Finance | $20,000 | 24 months | 0.75% p.a. |

| ICBC | $500 | 12 months | 0.6% p.a. |

| UOB | $20,000 | 10 months | 0.5% p.a. |

| Standard Chartered | $25,000 | 3 months | 0.45% p.a. |

| OCBC | $20,000 | 12 months | 0.4% p.a. |

| RHB | $20,000 | 12 months | 0.4% p.a. |

| CIMB | $1,000 | 3 months | 0.3% p.a. |

| HSBC | $30,000 | 6 months | 0.25% p.a. |

Fixed deposit board rates are usually very low, but every month, many banks come up with fixed deposit promotions to offer good rates. In 'normal', non-Covid-19 times, promotional fixed deposit rates can go up to 1.8% to 2% p.a. However, with the current sluggish economy, fixed deposit interest rates remain low — although they might still be better than savings accounts.

Fixed deposit board rates are usually very low, but every month, many banks come up with fixed deposit promotions to offer good rates. In 'normal', non-Covid-19 times, promotional fixed deposit rates can go up to 1.8% to 2% p.a. However, with the current sluggish economy, fixed deposit interest rates remain low — although they might still be better than savings accounts.DBS fixed deposit rates (Feb 2021)

| DBS fixed deposit rate | |

| Interest rate | 1.3% p.a. |

| Deposit amount | $1,000 to $19,999 |

| Tenure | 18 months |

Maybank fixed deposit rates (Feb 2021)

| Maybank fixed deposit rate | |

| Interest rate | 1% p.a. |

| Deposit amount | Min. $1,000 |

| Tenure | 36 months |

The next best alternative to DBS is usually a Maybank fixed deposit. In February, you can earn 1% p.a. with Maybank's Singapore Dollar Time Deposit. Unfortunately you have to leave it in for 36 months (3 whole years!) to earn that measly 1% p.a. [ms-inline-widget account_type='fixed-deposit' amount='10000' tenure='24' locale='en' country_code='sg' channel='fixed-deposit' product_slug='maybank-singapore-dollar-time-deposit' ]

The next best alternative to DBS is usually a Maybank fixed deposit. In February, you can earn 1% p.a. with Maybank's Singapore Dollar Time Deposit. Unfortunately you have to leave it in for 36 months (3 whole years!) to earn that measly 1% p.a. [ms-inline-widget account_type='fixed-deposit' amount='10000' tenure='24' locale='en' country_code='sg' channel='fixed-deposit' product_slug='maybank-singapore-dollar-time-deposit' ] Hong Leong Finance fixed deposit rates (Feb 2021)

| Hong Leong Finance fixed deposit rate | |

| Interest rate | 0.75% p.a. |

| Deposit amount | Min. $20,000 |

| Tenure | 24 months |

ICBC fixed deposit rates (Feb 2021)

| ICBC fixed deposit rate | |

| Interest rate | 0.6% p.a. |

| Deposit amount | Min. $500 |

| Tenure | 12 months |

takes the cake by requiring just $500 minimum deposit. You get an okay-ish 0.6% p.a. (if you apply for this fixed deposit online) with a commitment period of 12 months.

takes the cake by requiring just $500 minimum deposit. You get an okay-ish 0.6% p.a. (if you apply for this fixed deposit online) with a commitment period of 12 months. UOB fixed deposit rates (Feb 2021)

| UOB fixed deposit rate | |

| Interest rate | 0.5% p.a. |

| Deposit amount | Min. $20,000 |

| Tenure | 10 months |

Standard Chartered fixed deposit rates (Feb 2021)

| Standard Chartered fixed deposit rate | |

| Interest rate | 0.45% p.a. |

| Deposit amount | Min. $25,000 |

| Tenure | 3 months |

OCBC fixed deposit rates (Feb 2021)

| OCBC fixed deposit rate | |

| Interest rate | 0.4% p.a. |

| Deposit amount | Min. $20,000 |

| Tenure | 12 months |

RHB fixed deposit rates (Feb 2021)

| RHB fixed deposit rate | |

| Interest rate | 0.4% p.a. |

| Deposit amount | Min. $20,000 |

| Tenure | 12 months |

What about HSBC and CIMB fixed deposits?

The rest of the banks — CIMB and HSBC — are offering 0.3% or less on their fixed deposits, which is hardly worth your time. In fact, you can get 0.3% p.a. on your savings with no lock-in just by opening a regular CIMB FastSaver account. Of course, banks are notoriously fickle about their interest rates, and all these could easily change next month. For the latest promotional rates, remember to bookmark this page and our MoneySmart fixed deposit comparison page before you commit. Plus, here’s a quick and dirty summary of what you need to know about fixed deposits.Fixed deposit vs savings account — what's the difference?

https://youtu.be/Sq9hjlnEgY0 Once an attractive alternative to that pathetic 0.05% p.a. interest on savings accounts, fixed deposits — like so many ageing Channel 8 starlets — are fading from collective memory. Today, every bank in Singapore is competing for your dollar with high interest savings accounts, which may actually offer better returns. Here are the differences between fixed deposits and savings accounts at a glance:Dbs Fixed Deposit Calculator

| Fixed deposit | Savings account | |

| Tenure | As low as 3 months, but go for at least 12 months for better rates | None |

| Interest rate | The longer the tenure, the better the interest rate | Usually the same regardless of tenure |

| Amount to deposit | Fixed amount, usually at least $10,000 | Smaller initial deposit and minimum monthly balance ($500 to $3,000) |

| Currency | SGD by default, but some banks offer higher interest rates for foreign currency | SGD by default. There are a few multi-currency accounts, but no difference in interest rate |

| Can you withdraw? | Contrary to popular belief, yes, but you lose the interest | Yes, no impact on interest, but don’t fall below the minimum balance |

| Interest payments | Quarterly or annually | Monthly |

| Risk level | Virtually risk-free, insured up to $75,000 by Singapore Deposit Insurance Corporation (SDIC) |

Fixed deposit vs Singapore Savings Bonds (SSB) — which is better?

In an earlier article, we compared the Singapore Savings Bonds to fixed deposits. There are a few key distinctions between these virtually risk-free investment vehicles. First, interest rates. Believe it or not, fixed deposit interest rates are actually higher than SSBsPosb Fixed Deposit Rate

. The November issue of SSBs offers a measly 0.23% p.a. interest average return after the first 2 years, which you can easily beat with a well-chosen fixed deposit promotion. Next, entry point. It takes just $500 to invest in Singapore Savings BondsFixed Deposit Calculator

, which is lower than the $1,000 or more for most fixed deposits. That said, ICBC fixed deposits only require $500 to start. (On the flip side, there's a cap of $200,000 you can put into Singapore Savings Bonds. There's no cap for fixed deposits.) Finally, tenure.Dbs Fixed Deposit Account

Fixed deposits are shorter term investmentsDbs Fixed Deposit Promotion

. After the lock-in period is over, you should shop around again for another place to park your money. With SSBs, however, the interest rate climbs every year, so the longer you keep the money in there (up to a maximum of 10 years) the more you get. At the same time, SSBs have higher liquidity than fixed deposits. You will not be penalised if you withdraw your money at any point. You do have to pay a $2 transaction fee each time you buy or redeem a bond, though. Know anyone who likes to park their cash in fixed deposits? Share this article with them. [ms_related_articles] The post 7 Best Fixed Deposit Rates in Singapore (Feb 2021) — DBS, Maybank & More appeared first on the MoneySmart blog.Dbs Fixed Deposit Interest Rate

MoneySmart.sg helps you maximize your money. Like us on Facebook to keep up to date with our latest news and articles.