Cd Account Rating: 4,0/5 1550 reviews

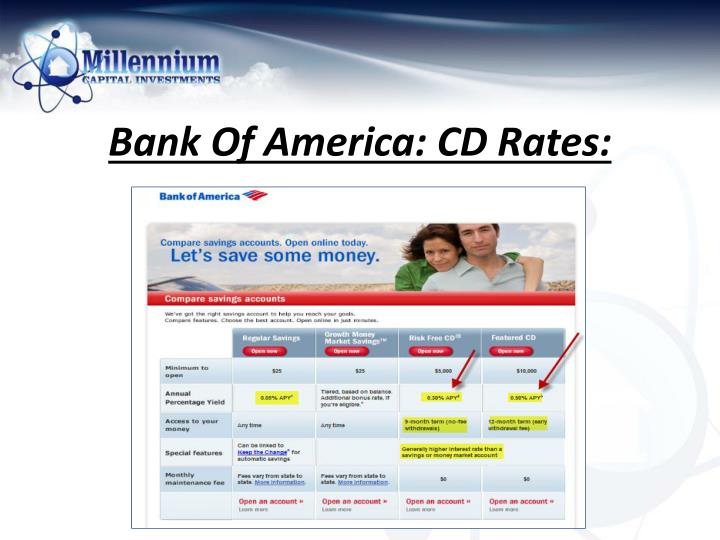

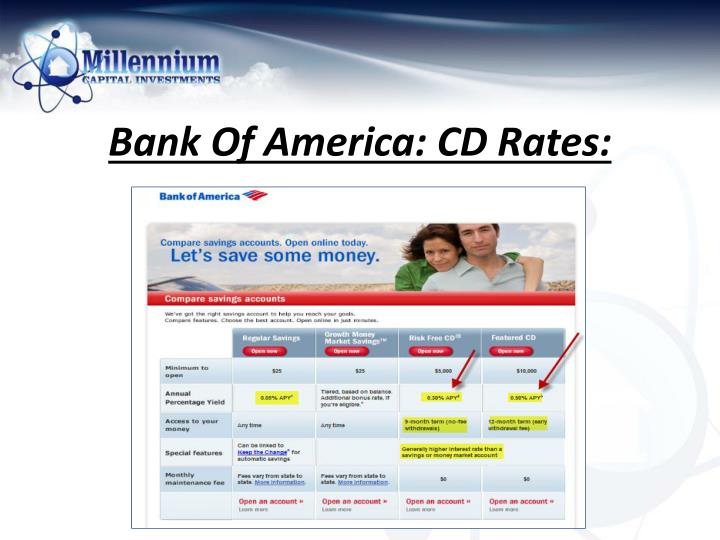

Annual Percentage Yield (APY) is accurate as of today. Advertised rate is fixed for the initial term of the Certificate of Deposit (CD) only. APY assumes interest earned remains on deposit until maturity. CD minimum opening deposit of $1,000 required. Early withdrawal penalty may apply if you withdraw any principal from the CD before the maturity date. Account fees could reduce earnings. Additional terms and conditions apply. Please refer to our Depositor's Agreement and applicable Schedule of Fees for additional information. Offer cannot be combined with any other promotional rate, bonus rate or special rate offer. BankUnited reserves the right to cancel or modify this offer at any time. Interest rates and APYs displayed are available only for accounts opened in a BankUnited branch. Rates are subject to change at any time and are not guaranteed until the CD is open. Please contact a BankUnited representative for additional details. CD will automatically renew at maturity into a standard CD closest in length to the initial term (which may be shorter or longer than the initial term) at the then current standard rate in effect at the time of renewal unless you instruct us otherwise. - Cd Account Us Bank

- Cd Account Calculator

- Cd Account Calculator Interest Rate

:strip_icc()/basics-of-the-cd-ira-315235-Final-c211c11d28734a7f83104425fd1a7b04.png)

Cd Account Us Bank

Cd Account Calculator

Cd Account Calculator Interest Rate

A CD is an account that typically offers a higher interest rate than a savings or checking account. However, your money is tied up in the CD for a predetermined length of time, known as the CD’s term. For a CD account, rates are subject to change at any time without notice before the account is opened. Your rate will be fixed on the business day‡ we receive your completed application, provided we receive your deposit within 30 days after your application is approved. A certificate of deposit (CD) is a time deposit, a financial product commonly sold by banks, thrift institutions, and credit unions. CDs differ from savings accounts in that the CD has a specific, fixed term (often one, three, or six months, or one to five years) and usually, a fixed interest rate.

:strip_icc()/basics-of-the-cd-ira-315235-Final-c211c11d28734a7f83104425fd1a7b04.png)